Swing Trading Strategy

Automate your trades and stay one step ahead of market swings. Designed for confident medium-term moves with minimal market noise.

Automate your strategy

-

accumulated profit

$2,587.00

-

time frames

4-Hour

Strategy Overview

-

Average trade duration: several days to a few weeks

-

Strategy type: medium-term, swing trading

-

Risk level: moderate

-

Recommended capital: from 2,000 USD

-

Monitoring frequency: daily

-

Skill level: beginner to intermediate

How does B-World automate a day-trading strategy?

-

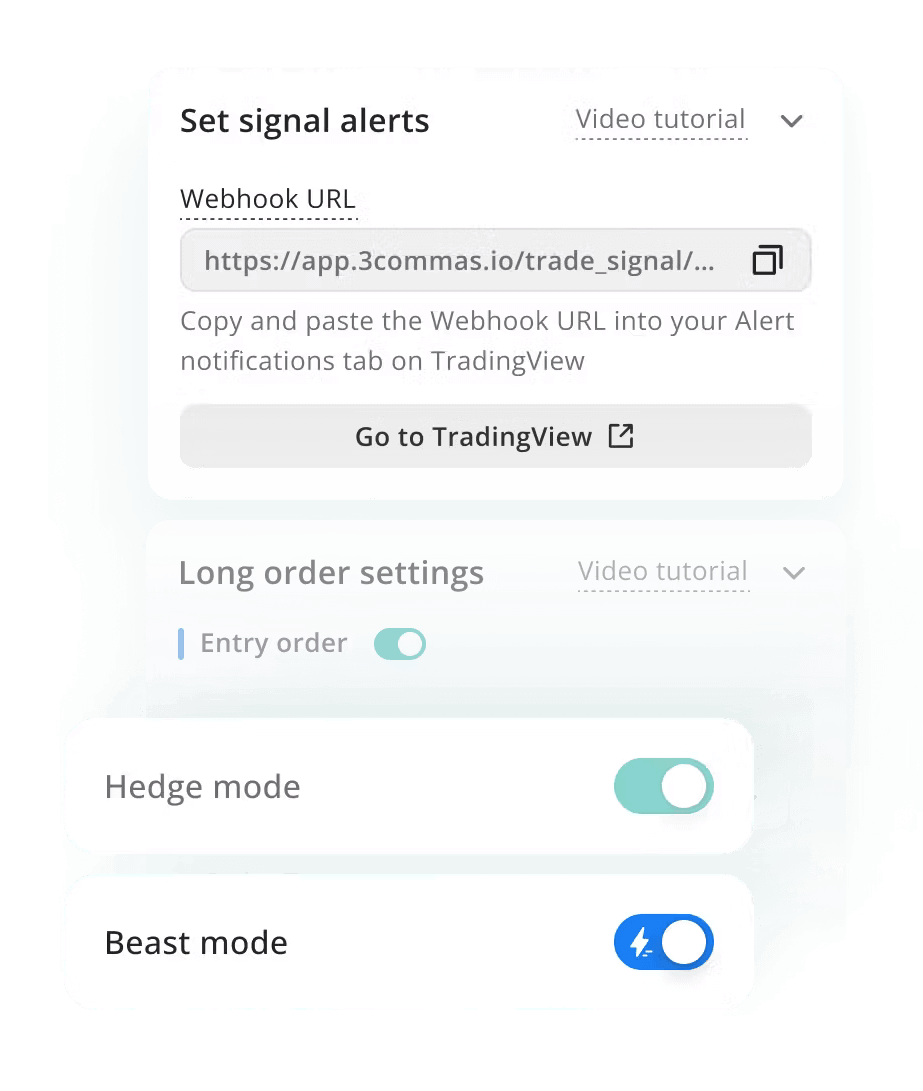

Swing Strategy Automation

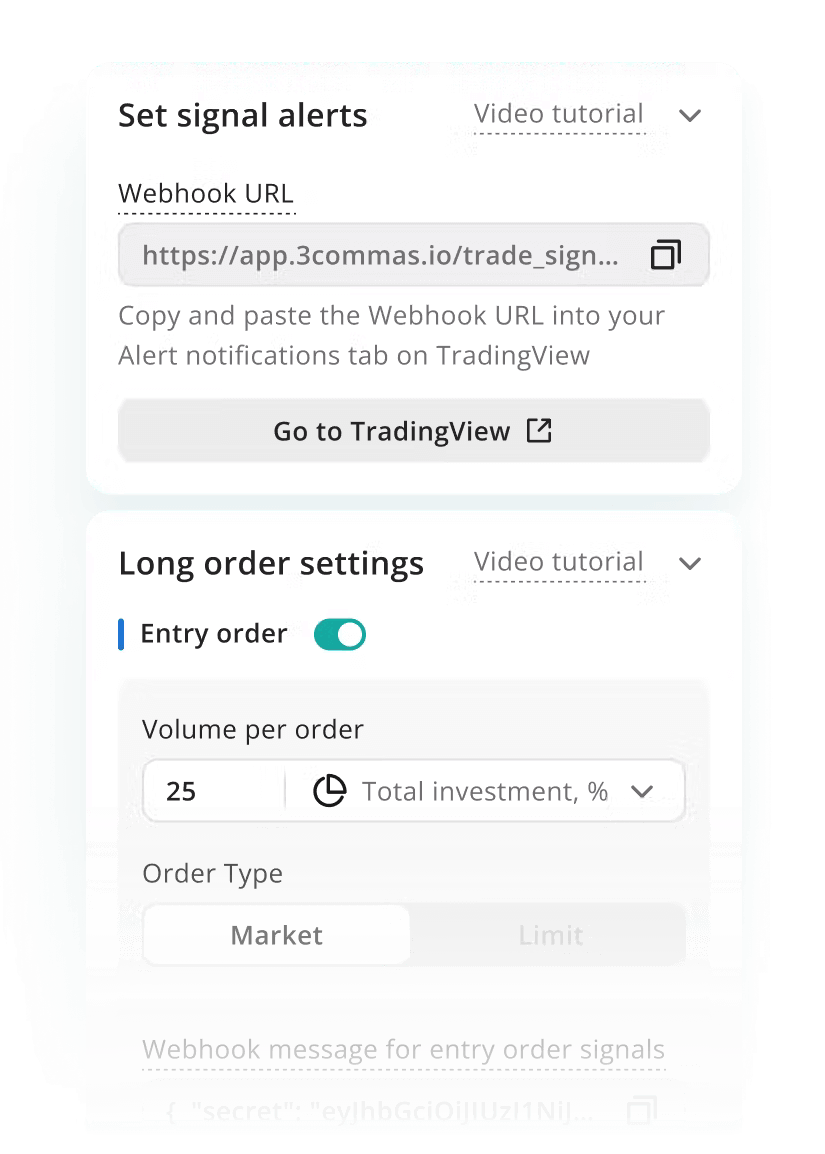

The bot can fully replicate TradingView strategies via a webhook, allowing multi-day logic to operate without any manual intervention.

-

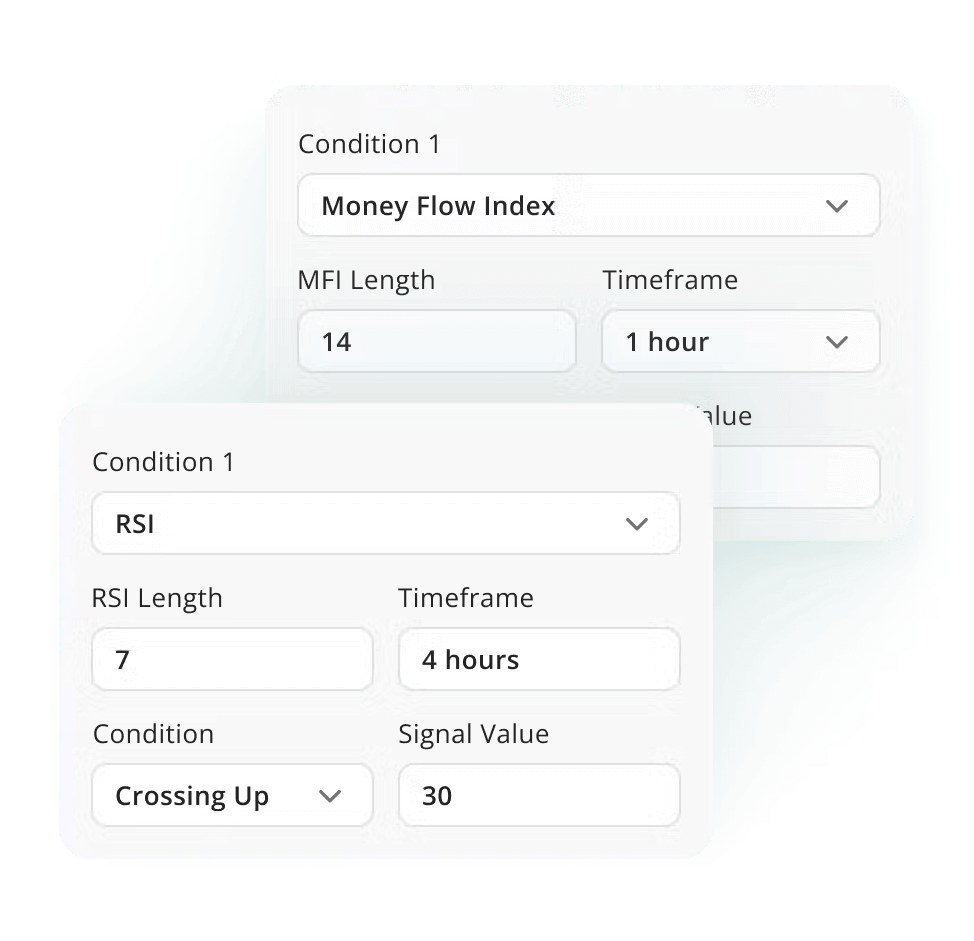

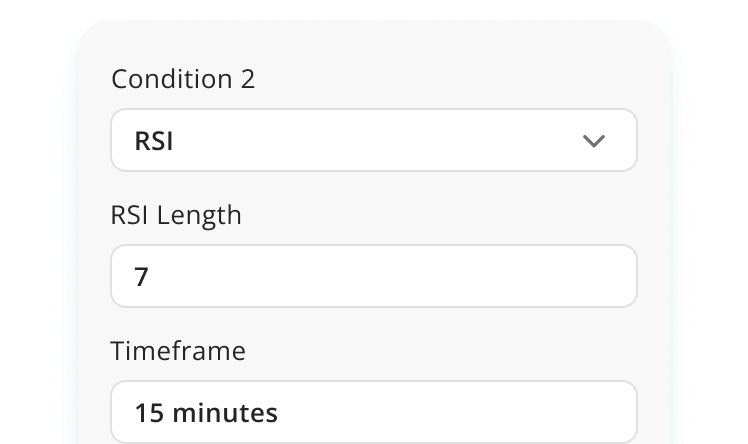

DCA Bot with Multi-Timeframe Indicators

DCA bot comes with over 11 built-in indicators, which can be combined on 1-hour and 4-hour timeframes to identify reliable entries into swing trends and mean-reversion zones, with clear confirmation of momentum or trend direction.

-

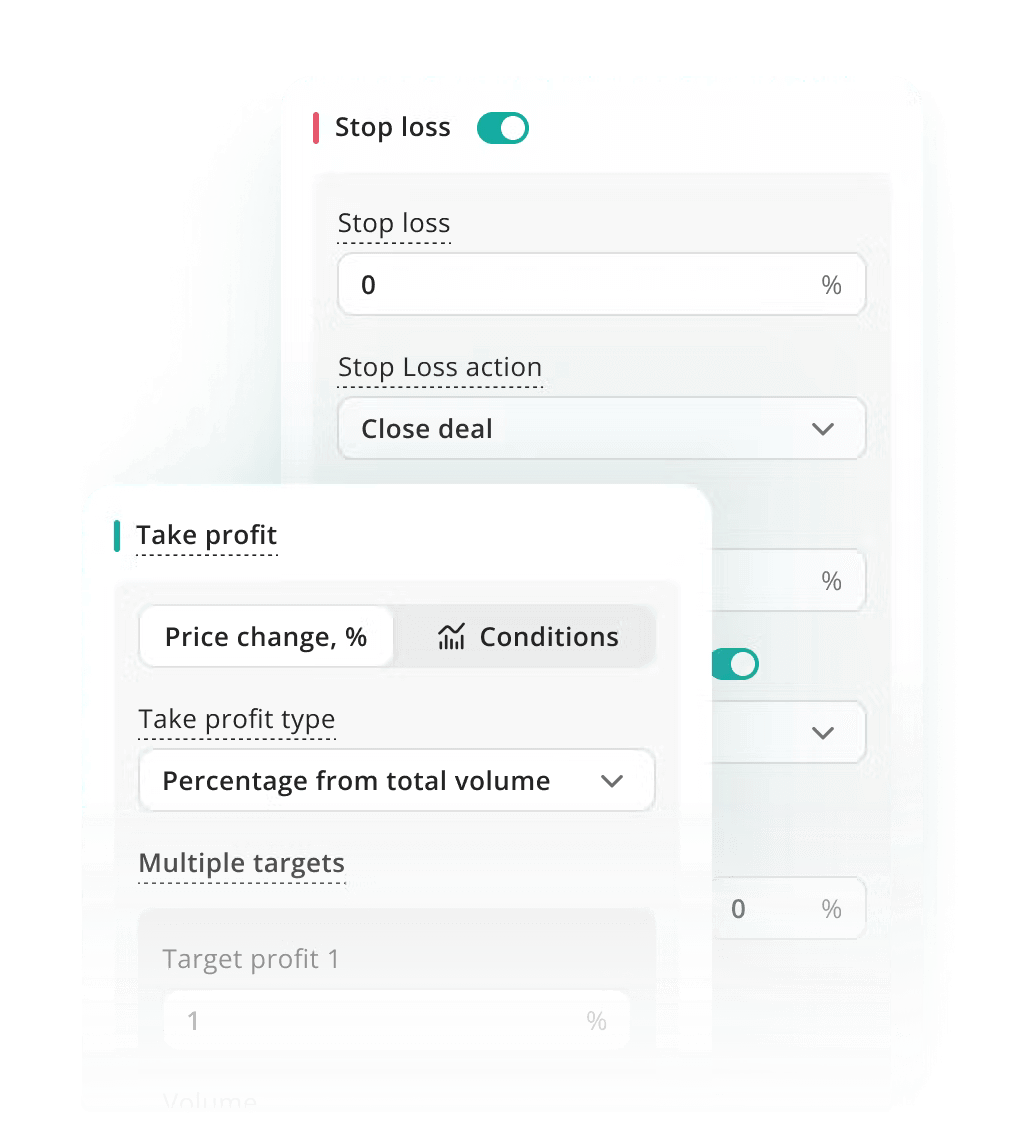

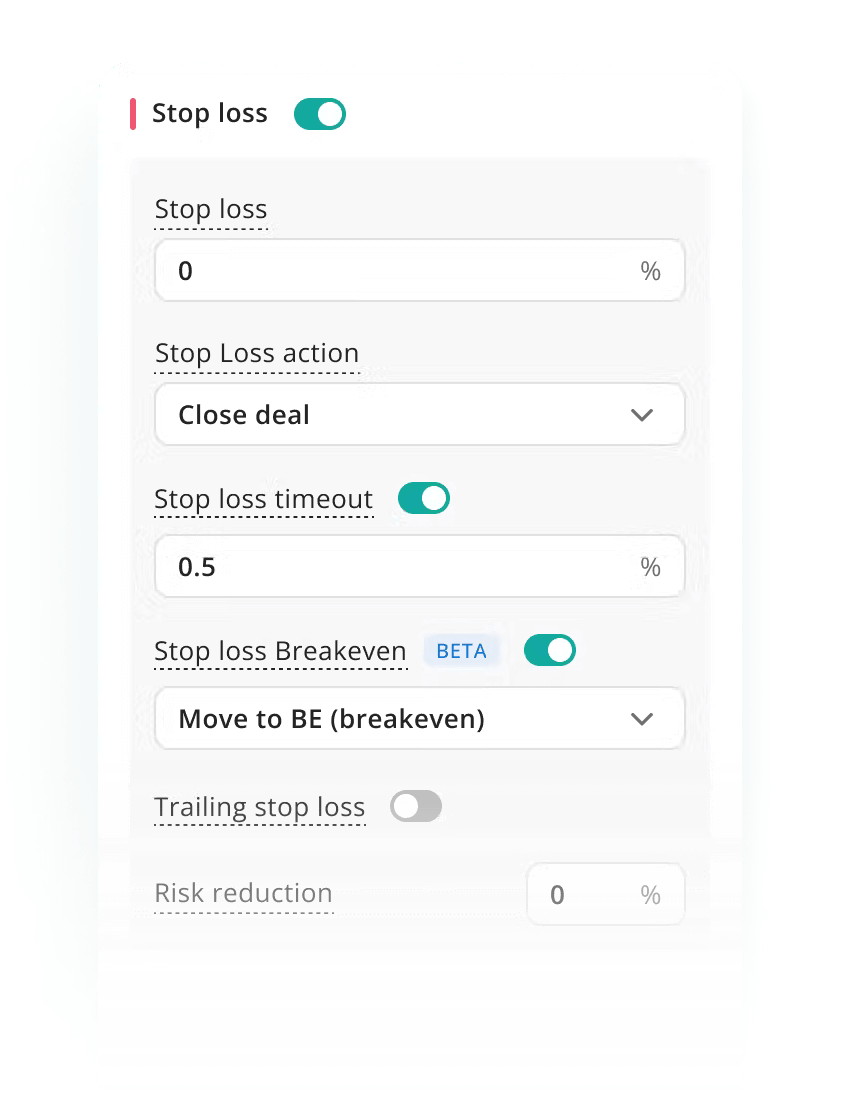

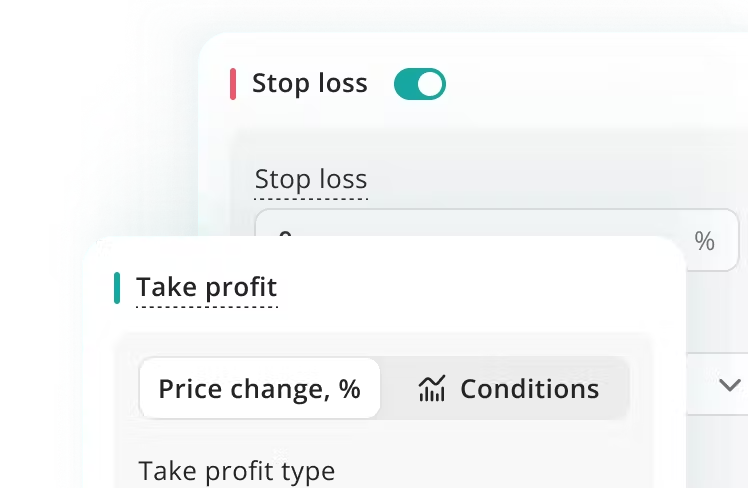

Multi-Purpose with Dynamic Protection

DCA and Signal bots support multiple take-profit levels with trailing options for extended market moves. Stop-loss, trailing-stop, and break-even logic help lock in profits during market reversals.

-

SmartTrade for Manual Entry with Automation

SmartTrade allows swing traders to open positions manually and then automate risk management with layered take-profits, stop-losses, trailing stops, and break-even mechanisms.

-

Dual-Sided Swing Trading

With hedge mode enabled, a single signal bot can manage both long and short positions simultaneously or automatically reverse direction based on your strategy’s logic and trading signals.

Start trading on B-World today

Unlock opportunities that manual traders simply can’t reach

Trade of the Day

What is a Swing Trading Bot?

Swing trading bots hold positions for several days rather than minutes, targeting larger price movements. They capitalise on short-term trends, automating smart entries and exits as the trade unfolds.

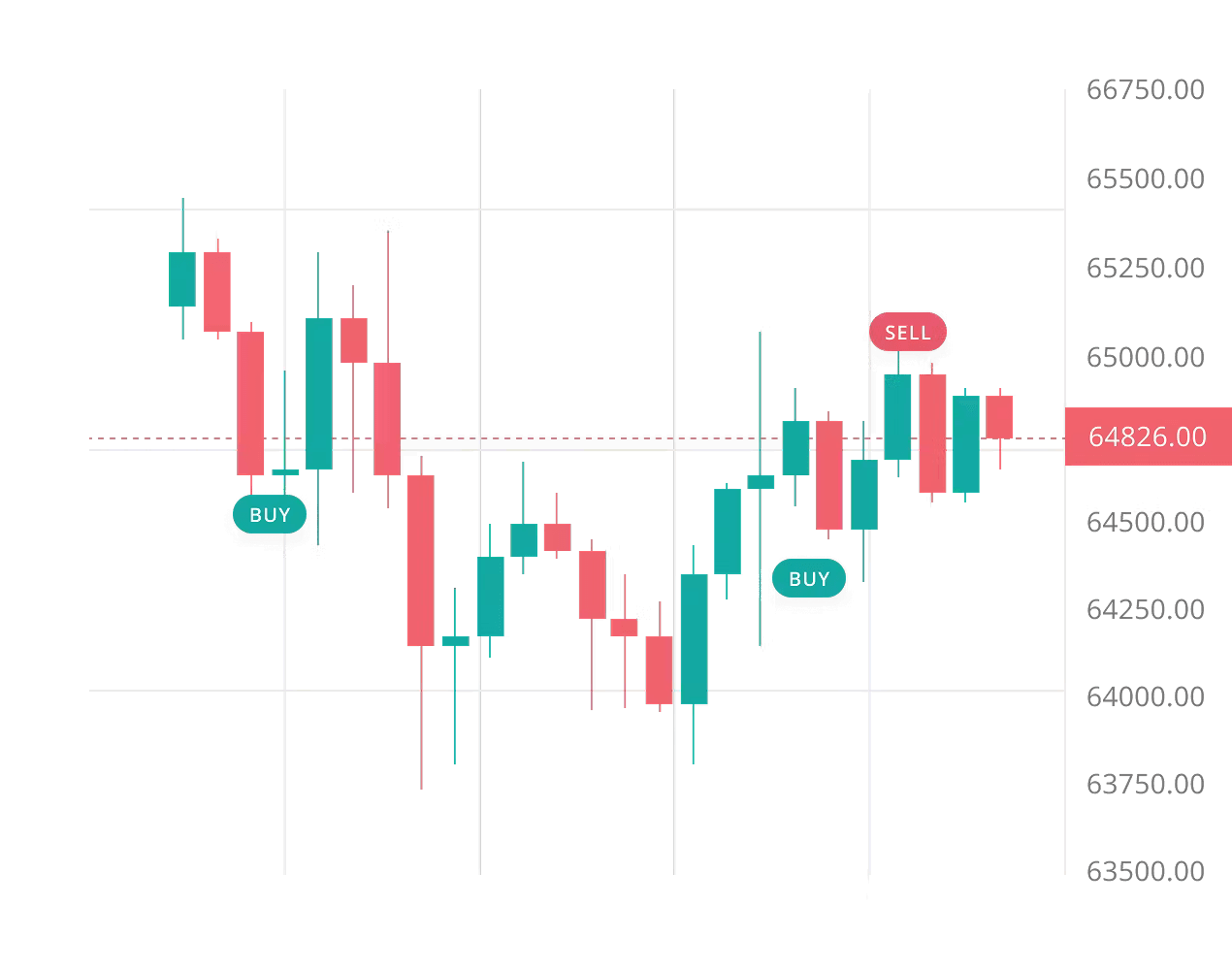

Swing Trading — Example

Steps to Automating Layered Entries — Smoothly Managing Multi-Day Moves

-

Identify momentum shifts using indicators

Set up signals with RSI, MACD, or Stochastic on 1H–4H charts. A DCA or Signal Bot can trigger trades once specific momentum conditions are met.

-

Layered entries and exits

Use DCA logic to scale into positions. Add smart take-profit targets and trailing stops to lock in gains as price swings unfold over several days.

-

Minimal oversight, maximum structure

Once a swing is in motion, the bot manages positions based on your setup. This removes the need for constant monitoring and helps maintain strategic discipline.

What’s the Difference?

Manual vs Automated Swing Trading

Manual trading is stressful and time-consuming. Automated swing trading with B-World runs 24/7, reacts instantly, and stays emotion-free - giving you the edge in fast-moving markets.

-

-

Name

-

Entry timing

-

Trade duration

-

Emotions

-

Risk control

-

Backtesting

-

Alerts

-

-

-

Manual Swing Trading

-

Relies on screen time

-

Fully manual operation

-

Often exits too early

-

Manual trailing stops

-

Labour-intensive

-

Requires third-party tools

-

-

-

Automated Swing Trading

-

Indicator-triggered entries and exits

-

Automatic profit targets

-

Follows a predefined plan

-

Built-in trailing stop

-

Integrated backtesting

-

All-in-one solution

-

Why aren’t you trading yet?

Let our technology handle the hard work while you focus on building your next innovative automated swing trading strategy.

Start your free trial-

No credit card required

-

No commitments

-

No hidden fees

Frequently Asked Questions

-

How can I use B-World’s swing trading tools for cryptocurrencies?

Swing trading tools help traders capture medium-term price movements lasting from a few hours to several days. On B-World, these include Smart Trade, DCA Bots, and integration with custom TradingView signals. You can set precise entry and exit levels, automate position sizing, and manage trades across multiple exchanges – making it a powerful solution for traders who don’t want to stay glued to the screen.

-

Can I automate my swing trading strategy with B-World?

Yes. B-World supports automated swing trading through bots that follow your predefined strategy. You can automate entries based on indicators such as RSI, MACD, or EMA, and let the bot handle exits using trailing take-profit or time-based logic. Your swing trading strategy runs 24/7 without manual input – ideal for traders who value consistency and efficiency.

-

How is swing trading different from day trading?

Swing trading focuses on capturing larger price movements over longer timeframes – from several hours to a few days – while day trading involves frequent, intraday trades. Swing traders rely more on broad technical patterns and require less screen time. With tools like B-World’s Swing Trading Crypto Bot, you can automate these longer setups while maintaining full control over risk and position management.

-

Is B-World suitable for beginners?

Yes, B-World is beginner-friendly, featuring a simple interface and preconfigured strategies to help new traders get started. You can use templates, safe settings, and real-time support to build confidence. Many users find it to be one of the best platforms for learning swing trading and transitioning to more advanced strategies over time.

-

Can I backtest my swing trading strategy on B-World?

Absolutely. B-World lets you test automated swing trading setups on historical data. You can fine-tune your entry indicators, timeframes, and risk management parameters before deploying your crypto swing bot with live funds. It’s an excellent way to validate performance across different market conditions.

Other Types of Traders

-

Learn more

Breakout Trader

Capture explosive moves as the price breaks through key levels. This approach focuses on identifying consolidation zones and anticipating strong moves beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes - profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where price frequently returns to its median value.

-

Learn more

Position trader

Think long term. Trade major price movements over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Scalper

Capture even the smallest price moves within minutes - succeed through speed and precision. Scalping requires split-second decision-making and works best with highly liquid pairs.

-

Learn more

Trend Follower

Follow the momentum - stay in the trade as long as the trend lasts. Trend following relies on confirmation signals and avoids the guesswork of calling tops and bottoms.

-

Learn more

Day Trader

Open and close trades within the same day - no time wasted. This strategy focuses on intraday trends and helps you avoid the risk of holding positions overnight.

-

Learn more

Breakout Trader

Capture explosive moves as the price breaks through key levels. This approach focuses on identifying consolidation zones and anticipating strong moves beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes - profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where price frequently returns to its median value.

-

Learn more

Position trader

Think long term. Trade major price movements over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Scalper

Capture even the smallest price moves within minutes - succeed through speed and precision. Scalping requires split-second decision-making and works best with highly liquid pairs.

-

Learn more

Trend Follower

Follow the momentum - stay in the trade as long as the trend lasts. Trend following relies on confirmation signals and avoids the guesswork of calling tops and bottoms.

-

Learn more

Day Trader

Open and close trades within the same day - no time wasted. This strategy focuses on intraday trends and helps you avoid the risk of holding positions overnight.

-

Learn more

Breakout Trader

Capture explosive moves as the price breaks through key levels. This approach focuses on identifying consolidation zones and anticipating strong moves beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes - profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where price frequently returns to its median value.

-

Learn more

Position trader

Think long term. Trade major price movements over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Scalper

Capture even the smallest price moves within minutes - succeed through speed and precision. Scalping requires split-second decision-making and works best with highly liquid pairs.

-

Learn more

Trend Follower

Follow the momentum - stay in the trade as long as the trend lasts. Trend following relies on confirmation signals and avoids the guesswork of calling tops and bottoms.

-

Learn more

Day Trader

Open and close trades within the same day - no time wasted. This strategy focuses on intraday trends and helps you avoid the risk of holding positions overnight.

-

Learn more

Breakout Trader

Capture explosive moves as the price breaks through key levels. This approach focuses on identifying consolidation zones and anticipating strong moves beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes - profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where price frequently returns to its median value.

-

Learn more

Position trader

Think long term. Trade major price movements over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Scalper

Capture even the smallest price moves within minutes - succeed through speed and precision. Scalping requires split-second decision-making and works best with highly liquid pairs.

-

Learn more

Trend Follower

Follow the momentum - stay in the trade as long as the trend lasts. Trend following relies on confirmation signals and avoids the guesswork of calling tops and bottoms.

-

Learn more

Day Trader

Open and close trades within the same day - no time wasted. This strategy focuses on intraday trends and helps you avoid the risk of holding positions overnight.

-

Learn more

Breakout Trader

Capture explosive moves as the price breaks through key levels. This approach focuses on identifying consolidation zones and anticipating strong moves beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes - profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where price frequently returns to its median value.

-

Learn more

Position trader

Think long term. Trade major price movements over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Scalper

Capture even the smallest price moves within minutes - succeed through speed and precision. Scalping requires split-second decision-making and works best with highly liquid pairs.

-

Learn more

Trend Follower

Follow the momentum - stay in the trade as long as the trend lasts. Trend following relies on confirmation signals and avoids the guesswork of calling tops and bottoms.

-

Learn more

Day Trader

Open and close trades within the same day - no time wasted. This strategy focuses on intraday trends and helps you avoid the risk of holding positions overnight.

-

Learn more

Breakout Trader

Capture explosive moves as the price breaks through key levels. This approach focuses on identifying consolidation zones and anticipating strong moves beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes - profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where price frequently returns to its median value.

-

Learn more

Position trader

Think long term. Trade major price movements over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Scalper

Capture even the smallest price moves within minutes - succeed through speed and precision. Scalping requires split-second decision-making and works best with highly liquid pairs.

-

Learn more

Trend Follower

Follow the momentum - stay in the trade as long as the trend lasts. Trend following relies on confirmation signals and avoids the guesswork of calling tops and bottoms.

-

Learn more

Day Trader

Open and close trades within the same day - no time wasted. This strategy focuses on intraday trends and helps you avoid the risk of holding positions overnight.