Scalping Strategy

Automate every step. React instantly to market moves with a strategy built for speed and control.

Automate the strategy

-

Cumulative profit

$4,088.00

-

Timeframe

5 minutes

Strategy Overview

-

Average trade duration: 1–15 minutes

-

Strategy type: short-term

-

Risk level: high

-

Recommended capital: USD 500

-

Monitoring frequency: constant

-

Skill level: intermediate to advanced

How does B-World automate a day-trading strategy?

-

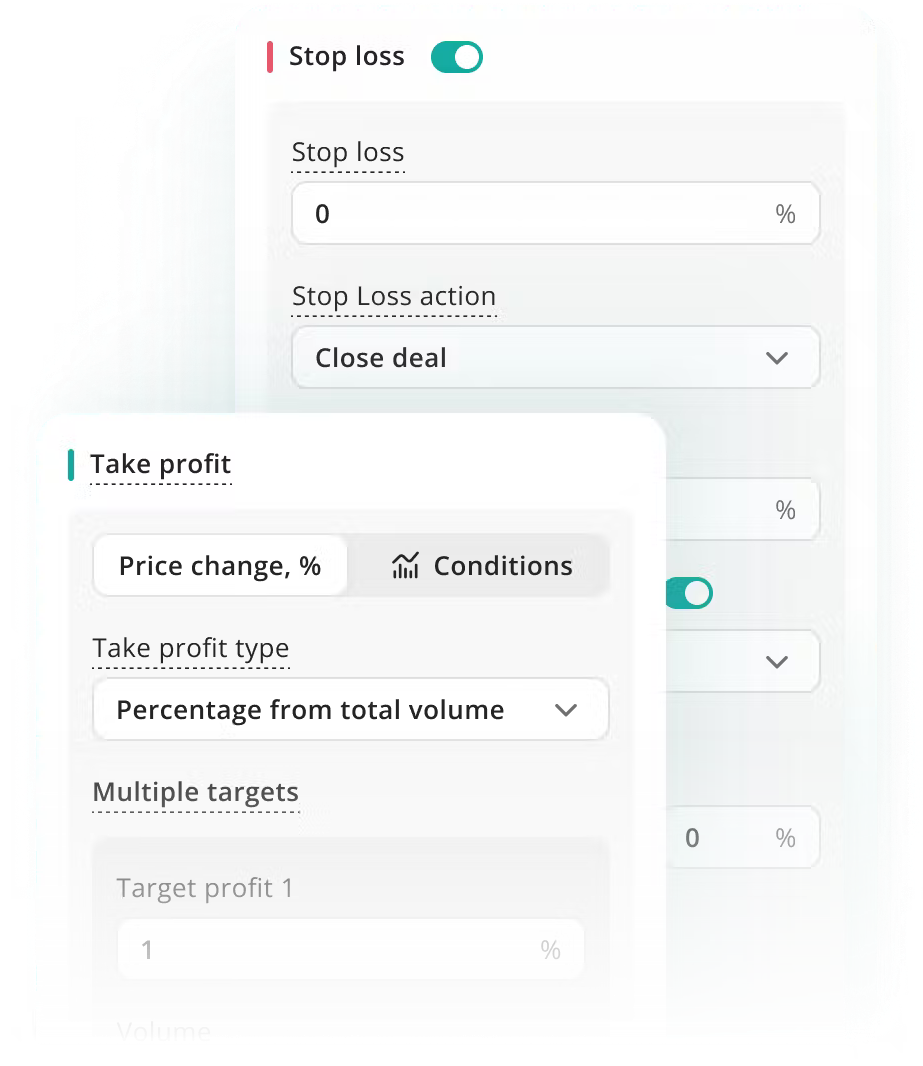

Instant order execution with TP and SL

DCA and signal bots allow instant trade entries based on signals while simultaneously placing Take Profit and Stop Loss orders — perfect for fast-moving market conditions.

-

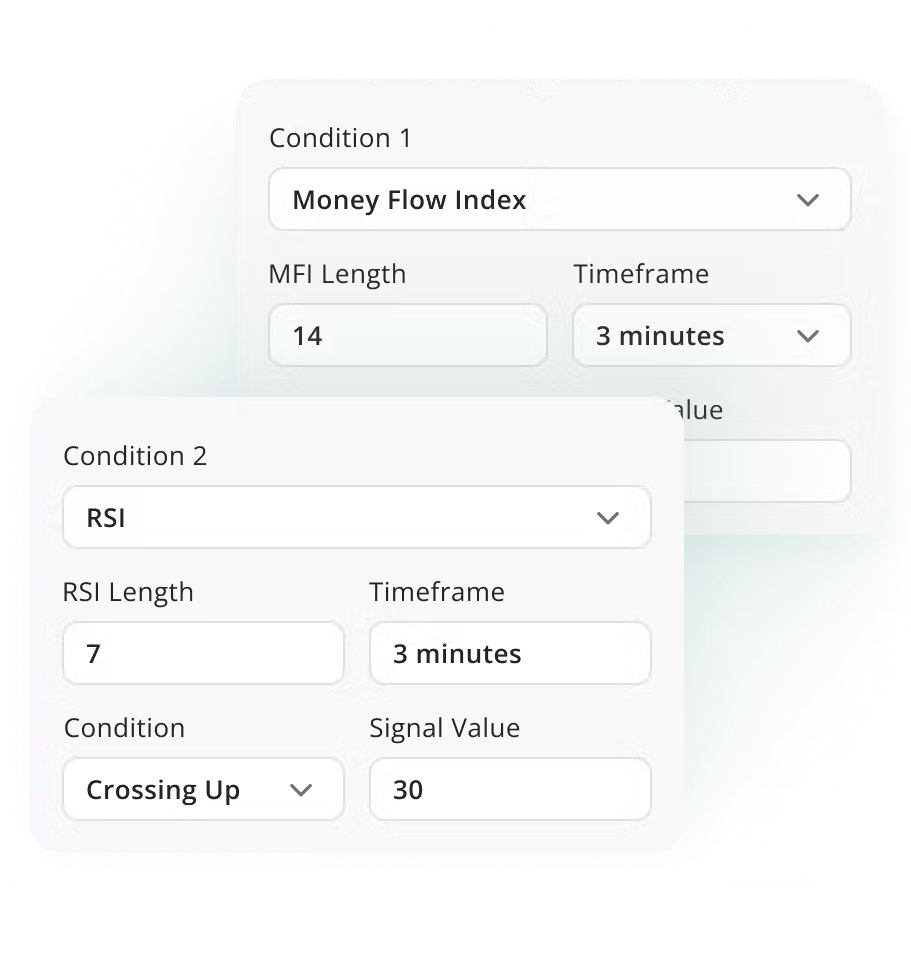

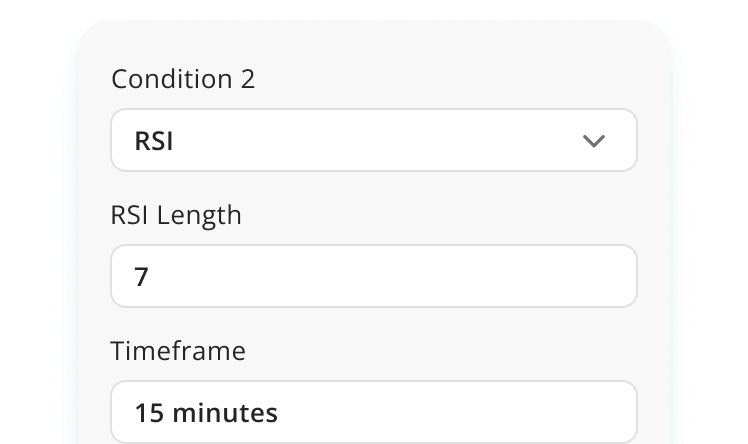

Built-in technical indicators

The DCA Bot comes equipped with over 11 integrated indicators (such as RSI, BB, and EMA) to automate entry and exit decisions using short-term scalping logic on 3–5-minute timeframes.

-

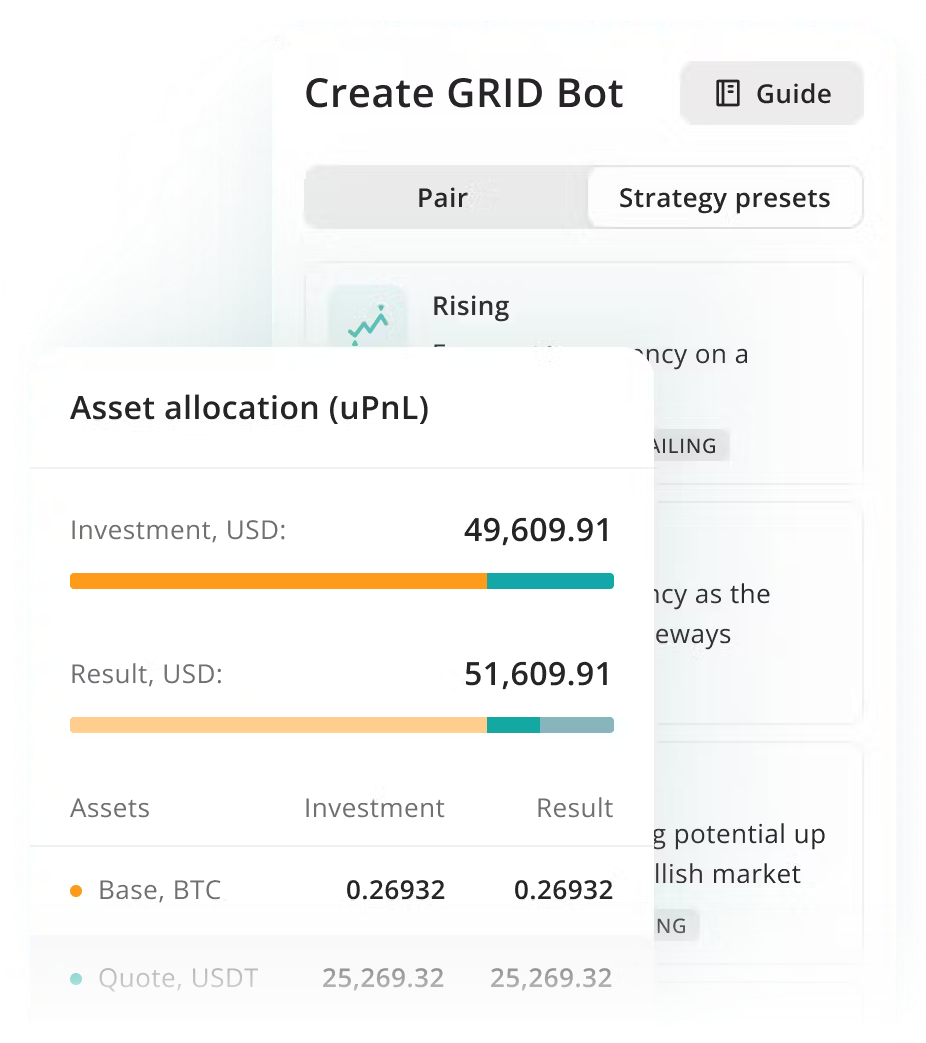

Grid bot with tight intervals

Grid Bot configured with narrow grid spacing captures micro-price movements, making it ideal for high-frequency scalping.

-

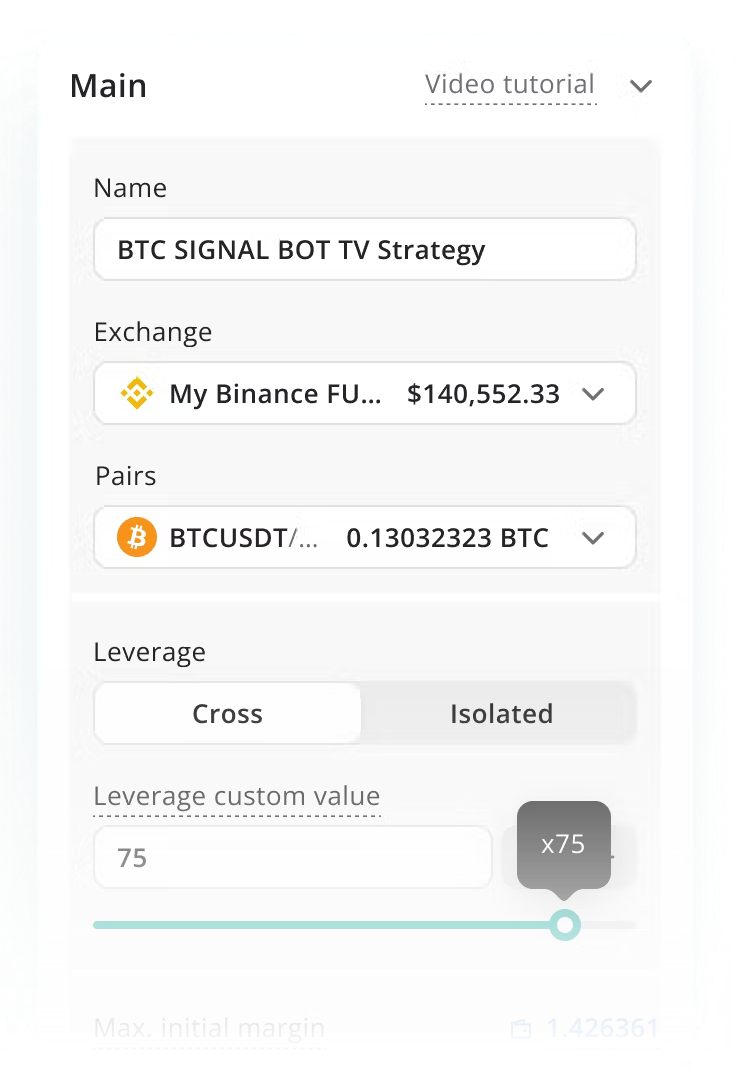

Signal bot with full TradingView strategy support

The Signal Bot supports TradingView strategies via webhook, ensuring full execution of your Pine script logic with 100% precision. Perfect for scalping systems that demand instant response and exact trade mirroring.

Start trading on B-World today

Unlock opportunities unavailable to manual traders

Speed

What is a scalping trading bot?

Scalping bots automatically monitor and react to minor market movements in real time. Perfect for traders who want action and results without staring at charts all day.

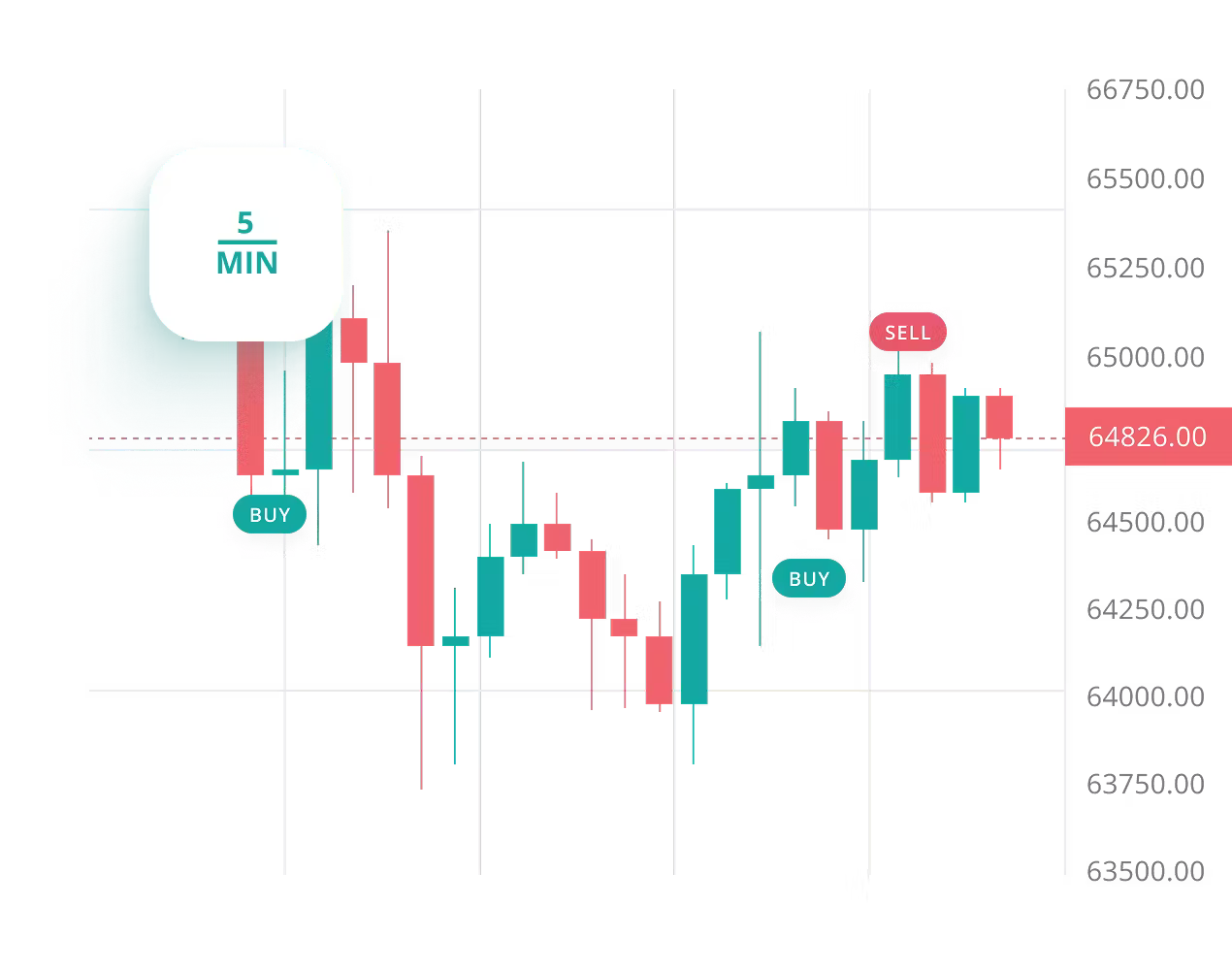

Scalping Trade Example

3 Steps to Faster Execution - built for speed and precision

-

Set up ultra-short signals

Use 3–5-minute charts with indicators such as RSI or EMA. The Signal Bot or DCA Bot instantly executes trades via webhook or internal signals.

-

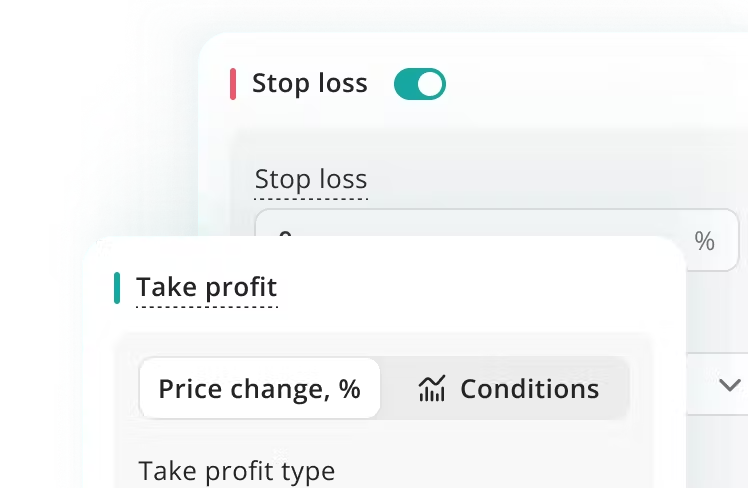

Combine with tight SL/TP and exit logic

Set narrow take-profit and stop-loss levels, plus optional trailing to capture every minor move. The built-in logic enforces discipline and consistency in execution.

-

Trade smart without burnout

The bot handles multiple rapid trades per session with zero delay, reacting faster than any manual process — ideal for volatile, high-liquidity pairs.

What’s the difference?

Manual vs Automated Scalping

Manual trading is stressful and slow. Automated scalping with B-World runs 24/7, reacts instantly, and stays emotion-free — giving you an edge in fast-moving markets.

-

-

Name

-

Focus

-

Emotions

-

Speed

-

Scalability

-

Consistency

-

Risk control

-

-

-

Manual scalping

-

Requires constant monitoring

-

Prone to emotional mistakes

-

Limited by human reaction time

-

Difficult to scale

-

Inconsistent performance

-

Manual adjustments required

-

-

-

Automated scalping

-

Operates around the clock, without breaks

-

Emotionless and rule-based

-

Instant reaction to signals

-

Easily manages multiple trades

-

Delivers consistent execution

-

Automatic stop-loss and take-profit

-

Why aren’t you trading yet?

Let our technology take care of the tedious work while you focus on building your next innovative automated scalping strategy.

Start a free trial-

No credit card required

-

No commitments

-

No hidden fees

Scalping Questions

-

Is scalping suitable for beginners?

Yes, though it requires some learning. B-World doesn’t offer a fully pre-built crypto scalping bot – instead, it provides powerful tools to help you design and automate your own strategy. You can use built-in technical indicators, templates, or connect TradingView signals. The interface is intuitive, and most traders with basic experience find it easy to master.

-

How much time do I need to manage the bot?

Very little. Once configured and launched, your scalping bot monitors the market 24/7. Most users check in occasionally to review performance or adjust settings. The main advantage of a crypto scalping bot is that it executes dozens of small trades without requiring your constant attention.

-

What exchanges does B-World support?

B-World supports a wide range of major crypto exchanges for both spot and futures trading.

-

Can I test my scalping strategy on historical data?

Yes. B-World includes a built-in backtesting tool for the DCA bot. You can test your scalping strategy on historical data before risking real funds – adjusting indicators, timeframes, entry conditions, and safety orders to instantly see how it would have performed.

-

Can I use my own TradingView script with the scalping bot?

Absolutely. The Signal Bot integrates with TradingView strategies via webhook, allowing your custom scalping logic – whether based on RSI, MACD, EMA, or any Pine script — to trigger live trades with 100% accuracy.

-

Why is automated scalping better than manual trading?

Manual scalping demands full focus and lightning-fast execution – not always practical. A bot never tires or gets distracted. It trades on logic, not emotion, reacting to tiny price movements in milliseconds. This gives you stability, scalability, and a real edge in volatile markets.

-

Is high-frequency crypto trading risky?

Yes, all trading carries risk – scalping even more so due to volatility. But bots help manage that risk by using stop-losses, fixed position sizes, and automated trade control. On B-World, you can define your risk per trade and fine-tune every parameter to match your comfort level.

Other Types of Traders

-

Learn more

Breakout Trader

Catch explosive moves when the price breaks through key levels. This approach focuses on identifying consolidation zones and waiting for strong momentum beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes — profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where the price frequently returns to its median value.

-

Learn more

Position trader

Think long-term. Trade major price movements that unfold over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Swing Trader

Use multi-day trends and profit from market swings. Swing traders often rely on technical patterns and momentum indicators to pinpoint entry opportunities.

-

Learn more

Trend Follower

Follow the momentum — stay in the trade while the trend lasts. Trend followers depend on confirmation signals and avoid guessing tops or bottoms.

-

Learn more

Day Trader

Open and close trades within a single day — no time wasted. This strategy targets intraday trends and helps eliminate overnight exposure.

-

Learn more

Breakout Trader

Catch explosive moves when the price breaks through key levels. This approach focuses on identifying consolidation zones and waiting for strong momentum beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes — profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where the price frequently returns to its median value.

-

Learn more

Position trader

Think long-term. Trade major price movements that unfold over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Swing Trader

Use multi-day trends and profit from market swings. Swing traders often rely on technical patterns and momentum indicators to pinpoint entry opportunities.

-

Learn more

Trend Follower

Follow the momentum — stay in the trade while the trend lasts. Trend followers depend on confirmation signals and avoid guessing tops or bottoms.

-

Learn more

Day Trader

Open and close trades within a single day — no time wasted. This strategy targets intraday trends and helps eliminate overnight exposure.

-

Learn more

Breakout Trader

Catch explosive moves when the price breaks through key levels. This approach focuses on identifying consolidation zones and waiting for strong momentum beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes — profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where the price frequently returns to its median value.

-

Learn more

Position trader

Think long-term. Trade major price movements that unfold over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Swing Trader

Use multi-day trends and profit from market swings. Swing traders often rely on technical patterns and momentum indicators to pinpoint entry opportunities.

-

Learn more

Trend Follower

Follow the momentum — stay in the trade while the trend lasts. Trend followers depend on confirmation signals and avoid guessing tops or bottoms.

-

Learn more

Day Trader

Open and close trades within a single day — no time wasted. This strategy targets intraday trends and helps eliminate overnight exposure.

-

Learn more

Breakout Trader

Catch explosive moves when the price breaks through key levels. This approach focuses on identifying consolidation zones and waiting for strong momentum beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes — profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where the price frequently returns to its median value.

-

Learn more

Position trader

Think long-term. Trade major price movements that unfold over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Swing Trader

Use multi-day trends and profit from market swings. Swing traders often rely on technical patterns and momentum indicators to pinpoint entry opportunities.

-

Learn more

Trend Follower

Follow the momentum — stay in the trade while the trend lasts. Trend followers depend on confirmation signals and avoid guessing tops or bottoms.

-

Learn more

Day Trader

Open and close trades within a single day — no time wasted. This strategy targets intraday trends and helps eliminate overnight exposure.

-

Learn more

Breakout Trader

Catch explosive moves when the price breaks through key levels. This approach focuses on identifying consolidation zones and waiting for strong momentum beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes — profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where the price frequently returns to its median value.

-

Learn more

Position trader

Think long-term. Trade major price movements that unfold over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Swing Trader

Use multi-day trends and profit from market swings. Swing traders often rely on technical patterns and momentum indicators to pinpoint entry opportunities.

-

Learn more

Trend Follower

Follow the momentum — stay in the trade while the trend lasts. Trend followers depend on confirmation signals and avoid guessing tops or bottoms.

-

Learn more

Day Trader

Open and close trades within a single day — no time wasted. This strategy targets intraday trends and helps eliminate overnight exposure.

-

Learn more

Breakout Trader

Catch explosive moves when the price breaks through key levels. This approach focuses on identifying consolidation zones and waiting for strong momentum beyond support or resistance.

-

Learn more

Mean Reversion Trader

Trade against extremes — profit when the price reverts to the mean. Mean reversion works best in range-bound markets, where the price frequently returns to its median value.

-

Learn more

Position trader

Think long-term. Trade major price movements that unfold over weeks or months. Position trading focuses on fundamental factors and macroeconomic trends rather than short-term price fluctuations.

-

Learn more

Swing Trader

Use multi-day trends and profit from market swings. Swing traders often rely on technical patterns and momentum indicators to pinpoint entry opportunities.

-

Learn more

Trend Follower

Follow the momentum — stay in the trade while the trend lasts. Trend followers depend on confirmation signals and avoid guessing tops or bottoms.

-

Learn more

Day Trader

Open and close trades within a single day — no time wasted. This strategy targets intraday trends and helps eliminate overnight exposure.